Choose the Product That Fits Your Needs

choose your spot

How to Find Online Loans that are Perfect for Your Needs

There are three parts to getting an online loan. Finding a lender (which we facilitate right here at CashSpotUSA.com). Next, you complete the loan application. Don’t worry if it sounds complex. It just involves filling out a four-section online form. Getting approved is the third step (you send the lender a bunch of documents for verification).

Now, online loans provide money quickly when you need it the most. But they aren’t permanent solutions to your financial woes. You get cash in your account, and after a couple of weeks, you begin making the repayments. And there is interest on top.

Take these scenarios to give you a big picture of how useful personal online loans are, compared to their counterparts issued by banks. Some of these scenarios are adapted from real-life tales told on the web.

“I recently embarked on a 9-5 job. But I’m getting paid after 4 weeks. I’m currently broke, with no money for bills. I desperately need cash. Please help!”

“We are happily in love but have pennies in our bank accounts. True love waits. But we don’t want a lack of money to shroud our burning love. Is there hope? Say something.”

“My car broke down by the side of the road. I’m still reeling from the shock of the prohibitive cost of having it towed. I thought insurance took care of that. Oh, was I wrong! I might sell the car since I have no money to fix it.”

“A while ago, I borrowed $300 for rent. I delayed in paying it back. Now my friend thinks I’m a deadbeat, and there has been a rift between us. I’m desperate for money again and terrified to even approach anyone I know for a loan.”

“My credit score is in the 580’s. I’m a member of a credit union, but they won’t generate a loan offer for me until my score reaches 620. Should I just take my chances with Bobby, my local loan shark?”

Some of these stories — funny or dire — might have struck a note. You just need to know that personal online loans can help. Whether you require cash before your next payday; money for your wedding; some dollars to fix your vehicle; or some credit without putting your life at risk.

When Were Online Loans First Introduced?

The first time loans were in-part issued online was in 1985, after Quicken loans introduced online loan applications & reviews. Now, there is a wave of online loan providers. They include traditional banks, online-only banks, credit unions, payday lenders, cash stores, peer-to-peer sites, and alternative lenders.

Popular Online Loans Types

Payday loan products: Do you need some cash before your employer disburses your next paycheck? Well, payday loans can help. The loan amounts are from $100 to $1,000. The problem is they are only permitted in about 37 states.

Lines of credit: Have you nailed down how credit cards work? You get a credit limit and the ability to make purchases with your card. With a line of credit, you withdraw the cash until you reach your limit. It makes them more flexible.

Online installment loans: We are focusing on these products in this article. And they mirror personal loans offered by banks, only that they are offered on the web. You borrow from $500 up to $35,000. Interest rates are fixed for the entire loan duration.

The payment schedule is also unique. You repay the loan in equated monthly or biweekly installments. For instance, if you paid $500 in the first month, on the last installment you still pay $500. The loan term can be up to 60 months.

Online loans for poor credit: These are personal loans meant for borrowers with marred credit scores. They are structured differently. Why is it so?

Let’s reason out: If you were a lender lending to a customer who has issues paying off loans, you might charge them higher interest rates, reduce the size of the loan, and shorten the loan duration.

Features of Online Loans For Poor Credit

| Feature | Explanation |

| Loan amount | $500 to $5,000 (Up to $10,000 with selected lenders) |

| Loan term | 3 months to 24 months with an option for early repayment. |

| APR | Double-digit or triple-digit. It makes these loans more expensive. |

| Collateral | No collateral (unsecured). |

| Credit score types | Fair FICO scores (580 to 669) & poor FICO scores (300 to 579). |

| Installments | Equal monthly or biweekly |

“We Can’t Predict Your Interest Rates!”

Yap, it’s a jarring confession to make. And that’s not the whole crux of the matter. Even the lender can’t predict your interest rate until you apply for the loan. Lenders usually quote APR ranges on their websites. For instance, they might charge 10% to 36%.

So what happens when you apply for the loan? The loan’s underwriters or a computer algorithm tries to estimate the interest to charge based on your income level, credit history, credit scores, loan term, loan amount, repayment schedule (biweekly or monthly), nature of employment, etc.

Online loan companies, typically referred to as Fintech Lenders, also use data from non-traditional sources. Some may look at how promptly you pay your utilities.

With all that data, it seems that it takes a long time to get approved for a loan. Well, all the fancy terms you hear thrown around, “automation, algorithms, & AI” constitute the technologies employed to speed up lending decisions. You may know if you have been approved for an online loan in a matter of minutes.

Why Personal Online Loans?

The simple reason would be “because you need money.” But we are seeking to explain clearly why you should choose them instead of borrowing from friends, selling off your assets, taking out a home equity line of credit, etc.

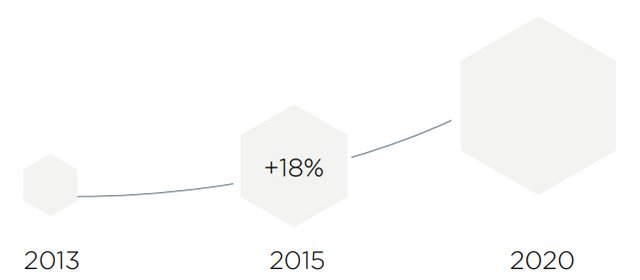

Stats speak volumes. And according to an article published in the Washington Post, up to 20 million Americans turned to personal loans by 2019. They are experiencing unprecedented growth. The Chamber of Commerce reported that they are the fastest-growing segment of consumer lending in the US.

Why are “popular online loans” so demanded? Well, here are six main benefits to answer the question:

Forget the long commute to the bank; the hustle of searching for a parking spot; and the daunting task of explaining to the loan officer why you need money in the first place.

Apply for a loan online, and you’ll be struck by the ease of the whole process. You fill out a simple form. Regardless if it’s during the daytime or at night, you can submit the application and await the lending decision.

The average loan application form takes about 10 minutes to fill out. How many applications can you logically submit in an hour?

In one hour (60 minutes), you can visit six different lender websites, and send out six loan applications.

Loan companies interested in you, respond by sending loan offers to your inbox. The email you receive typically states the locked interest rate, maximum loan amount, etc. By comparing offers, you can narrow down the providers offering the best rates.

### Valuable Tip ###

Don’t apply to lenders who conduct a hard credit check to pre-qualify you. Look for those that carry out soft checks.

Don’t fret if you have not understood the car reference, yet. Online personal loans are like supercars. Traditional loans are as slow as tractors. With a traditional bank loan or credit card, several business days may elapse before you’re approved.

And how long does it take to get funds with an online loan? Just one business day on average. Some alternative loan companies fund customers on the same day they applied. Now that’s what you call fast!

Some banks take several business days after approving your loan to distribute the funds. With online lenders, loan disbursal takes place right after you’re approved and have signed the loan agreement. Online lenders prefer making direct deposits to your bank account. It takes less than 24 hours for funds to become accessible during business days.

When running a business, having high expenses means you need more profits to breakeven. Online direct lenders run small operations. They may have a few staff members, offices in a less expensive part of town, etc. Even if they discount their rates, they can still breakeven quickly and make profits.

There are no intermediaries when working with online loans direct lenders. Engaging with the loan company on a one-to-one basis is safer, more affordable, and support can be sought with ease.

Before You Get a Loan Online: Success Tips to Follow

You have to follow a set of rules to have the most success in life. Similarly, there are a bunch of rules to abide by to get a loan online with less hustle.

#Rule 1: Assess Your Credit & Income Situation

Start with the simple question: What is my credit score? You can get a free credit score assessment from some sites. Knowing your credit scores gives you an indication of the type of lender to approach.

You might find accounts to be boring. But it helps to weigh your income amount against your fixed monthly obligations such as housing expenses, debts, etc.

For instance, if your discretionary income is currently $300, the most affordable loan product should have repayments that are no more than 50% of the discretionary amount.

#Rule 2: Don’t Underestimate the Power of Reviews

Once you narrow down your search to a particular company, it helps to know what people are saying about them. The Internet might have made the world one big village. But chances are your friends or family members might have never engaged with the company.

Plenty of customers have, and they tend to comment about the service they received. You can find reviews on sites like Yelp.com, Trustpilot.com, щк BBB.org.

Another handy Internet truth: Happy customers are less likely to leave reviews than disgruntled customers who received subpar service.

If you can get referrals from close associates, all the better. Take a step further by speaking to a loan consultant/financial adviser. Your ultimate goal should be to find a company that ticks all the boxes when it comes to offering genuine online loans.

#Rule 3: Verify That You’re Working With a Licensed Lender

The police flash their police badges. Bouncers filter clubbers by asking for ID.

When it comes to online loans, you must also verify that you’re dealing with a reputed party.

Any loan company must obtain state approval to offer a loan online in the jurisdiction. They are issued with certificates, which are usually displayed on their “Rates & Terms” pages. Working with a licensed lender ensures you’re protected by lending laws in your state. Now, you might encounter tribal lenders. They operate from tribal territories and tend to enjoy sovereign immunity.

#Rule 4: Work With an Experienced Lender

What does that popular quote about experience say? Oh yeah, “Experience is the best teacher.”

Well, working with an accomplished lender gives you confidence. For instance, the company will have originated thousands of loans. In the process, they might have learned what borrowers want and the challenges they face. A lender with a solid track record also has a name to protect and might be less inclined to engage in dubious practices.

#Rule 5: Review the Loan Agreement Before Signing It

In the past, no one used to read the manual! Nowadays, we pretty much skip the terms & conditions part when submitting online forms.

But when it comes to online loans, you must read the fine print of the loan you’re getting. The loan agreement serves as a legally binding contract. If you fail to honor the terms & conditions, the eventuality is getting sued in a court of law and having your wages garnished.

What should you look out for? Check to see if the lender is charging extra fees. Pay attention to the loan’s features (APRs, term, etc.) Also, note the lender’s policy on late payments and defaults.

Safe Online Loans – Tips for Maximum Safety

On the web, someone can assume a false person and scam you. Sorry to play on your fears, but it’s vital to borrow safe loans online.

The danger of getting scammed is only the start. When you fill out loan request forms, you usually enter very sensitive information. Some of the details, which are enough to make anyone flinch, include:

- Bank account number & routing number

- Date of birth

- Driver’s license number

- Employer’s name, address, and phone number

- Full names, street address, and apt & suite number

The worst situation is if your info fell into the wrong hands, and you end up a victim of identity theft. Another more mild eventuality is having your details at the hands of marketers & receiving unsolicited loan offers.

Avoiding online loans entirely is not the way to go. Millions of Americans borrow them without any issues. If you want to land safe online loans, here are some vital questions to seek answers to:

“Does the Lender Have Valid Contact Details & Physical Address?”

Despite issuing loans online, many loan companies maintain physical offices. Genuine companies also have working contacts and support email addresses. Some companies have integrated live chat on their sites.

So, take the time and call their number, especially if they are fairly new and largely unknown in lending circles. Also, establish that the lender is not operating out of their garage. You should ascertain that they are based in a commercial area with other offices.

“How Long has the Lender been Operating?”

Anyone can draft an “About Us” page and claim the company is ten years old. But here is a nifty trick to establish how long the lender has been around. First, check out the age of their website. Just search for sites with domain age checker tools. Also, view their social media pages, especially Twitter. It will state the year the page was created. Past posts can also tell you how long the company has been using social media.

“Is the Lender Asking for an Advance Fee?”

Online scammers can create very convincing websites. Right before approving your loan, they might request you to send them an advance sum of money. The reason given might be to ensure you’re a serious customer. Funds are typically requested via wire transfer, which is hard to trace and impossible to reverse.

The only loans that you pay money in advance are mortgage. These fees are paid when the loan closes. All the fees for installment loans have to be included in the loan’s APR. You pay them together with the interest rates.

“Are the Fees and Interest Rates Too Prohibitive?”

Another danger tied especially to bad credit loans is overpaying for the service. For instance, you might get charged an origination fee of above 5%. Ideally, the origination or administrative fees should range from 1 to 5%. If the interest rates are also 800% plus, it’s better to skip the loan altogether.

“Is the Lender’s Website Secure and Safe?”

Some sites are knock-offs of real lending websites. The first step in identifying a phishing website is checking the URL. If the site encrypts communications to the server, it will have a secured padlock next to the website address. However, some dubious sites now use HTTPS, so it’s not a foolproof way of identifying a fake site.

That’s why it’s important to also check the site for errors, for instance, in spelling or grammar. You can also perform a “WHOIS” check to see who owns the URL. Next, check reviews for that particular lender. And finally, see if they have trusted badges on their site issued by payment processors, security providers, or associations like the Online Lenders Alliance (OLA).

“Is the Loan Company Making Outrageous Claims?”

Another suspicious move to watch out for is a lender promising “100% guaranteed approval.” Online business loan lenders can’t approve every single applicant notwithstanding their income or credit score type. Why? Well, they are in the business of offering loans. And in business, you’ll make losses if you don’t prudently vet borrowers.

Some companies might also promise a substantially high direct online cash loan that doesn’t match your credit history or income amount. If you bite on more than you can chew, you might end up trapped in a vicious circle of debt.

As an example, here is how customers fall prey to bad payday lenders.

“Harry borrows a $1,000 loan that has to be repaid within 14 days. The loan company does not assess his ability to repay the loan. On the repayment date, he lacks sufficient funds to clear the debt in full. The loan company proceeds to roll over the loan. Basically, Harry pays an extra fee that allows the lender to extend the loan’s due date. After 3 months, he wonders why he can’t clear the amount as it’s constantly piling up.”

This practice is so dangerous that it’s banned in about 21 states. That’s why you should not be quick to take out a high loan amount. Borrow reasonably by first figuring out the amount you need. Don’t get tempted by juicy loan offers.

Other Red Flags to Watch out For

1) Unsolicited email & mail loan offers

In today’s digital world, we tend to leave digital footprints everywhere we go. For instance, how many times have you signed up on a website and forgot about it?

Your details may end up sold and purchased by loan marketers. They may access your credit report through soft checks and send offers telling you that you have been approved for a certain amount. The next step is usually applying.

If you were not shopping for a loan in the first place, it’s best to avoid these loan offers. You might end up with a problematic loan.

2) Threatening phone calls

Scammers have been known to prey on unsuspecting borrowers using fear tactics. For instance, you might receive a call from a blocked number telling you that you have an outstanding debt that needs to be cleared immediately.

The caller might claim to be a loan enforcement officer or judge. If you fail to pay, they might threaten arrest. Some calls can even appear to originate from your local area but are usually faked via VOIP services.

3) Lowly rated & unprofessional loan providers

Reading online reviews is often not enough. Even good companies might have begun neglecting customers. So, here is a short procedure for carrying out your own due diligence.

- Call their phone number: Actually phone in and ask to speak to a loan representative. The way they handle the call can tell you much about the company. For instance, are the reps knowledgeable, rude, or clueless?

- Watch out for their response times: Does the company claim to offer 24/7 support, but your emails have gone unanswered for several days?

- The quality of the lender’s website can also speak volumes: Does their site look like a yellow page from the ’90s? Even if they have a modern site, find out if they give the customers all the information they need to borrow successfully. Some companies will keep their interest rates and fees in secret. They might not even display the state licenses.

Access Online Direct Lenders Through CashSpotUSA

As we wind up this long article, it is vital to know who you’re dealing with. CashSpotUSA is not a direct lending company. Our platform is a resource that reviews online lending sites. For instance, if you want to find installment loans, you just visit the relevant page and find all the reputed players.

It’s much better than dealing with a loan matching service. These websites claim to work with a network of direct lenders, only that you don’t know who they are until you submit your application.

Some loan matching services send out your data to multiple lenders. And who is to say that these companies will not abuse your info.

The Final Word on Borrowing a Loan Online

“Online personal loans” are credit products that are unsecured and repaid in fixed installments. Other popular online credit options include payday loans and lines of credit.

Your loan’s interest rate is a play of many factors, including your income, loan duration, amount, etc. You can borrow safe online loans by working with experienced lenders. Safe loans are also manageable. Reputable lenders don’t ask for initial payments or make false claims.

Finally, promptly pay back your loan as per the repayment schedule. Having to deal with late fees or insufficient fund fees (from banks) will only make your loans more expensive. In case you default, you might end up in a worse financial position than you’re currently in.

Online Loans Near Me

If you were eager to find a loan online, you might have searched for “payday loans near me online,” or used a similar search phrase. Securing a good loan online is not as simple as typing into the browser “online loans near me.” That’s because the web is filled with many lenders, some operating unscrupulously, and some genuine. Similarly, the best lenders are not necessarily the first sites that pop up on the first page of payday loans online near me search results. Websites that usually rank on the first page may be spending a lot of cash on SEO or advertisements.

Fortunately, all hope is not lost as getting an online loan near me is not impossible. All we recommend doing is finding a loan through a loan matching service, like CashSpotUSA. Though we are not direct lenders, the platform gives customers access to the best payday loans.

If you’re searching for “online loans near me,” on this site all you need to do is provide a zipcode as you fill out the loan application form. You’re then matched to the most appropriate loan companies.